When financial emergencies strike, many people turn to Payday Loans Eloanwarehouse as a quick solution. These loans promise fast approval, no credit checks, flexible repayment terms, and almost instant cash transfers. At first glance, this might sound like the ideal option for anyone in urgent need of money. However, behind these attractive features lie significant risks such as extremely high interest rates, hidden fees, and aggressive collection practices. In this article, we’ll take a closer look at what Eloanwarehouse offers, weigh the pros and cons, compare it with safer lending alternatives, and help you make an informed financial decision.

Understanding Payday Loans Eloanwarehouse

Payday Loans Eloanwarehouse are quick, high-interest lending options created to give borrowers instant access to money. Unlike traditional bank loans, these payday advances do not require credit checks and are often approved within 24 hours. The convenience and speed make them appealing, particularly to borrowers with bad or limited credit history.

The convenience is offset by extremely high borrowing costs, as rates can reach 400%–700% APR, and additional fees often lead borrowers into a cycle of debt.

Key Features of Eloanwarehouse Payday Loans

To understand why borrowers are drawn to Payday Loans Eloanwarehouse, let’s break down the main features:

-

Quick Approval and Funding: Funds are usually deposited within 24 hours after approval.

-

No Credit Check: A major selling point for people with poor or no credit history.

-

Flexible Repayment Terms: Borrowers are classified into categories (new, silver, gold, platinum), and repayment can be stretched from 6 to 12 months.

-

Online Application: Everything is processed digitally, making the process convenient and accessible.

-

Borrowing Range: Loan amounts typically range from $300 to $3000, depending on eligibility.

On the surface, these features may seem to provide relief during emergencies. Yet, when you look at the actual borrowing costs, the picture changes completely.

The Pros of Payday Loans Eloanwarehouse

While critics emphasize the risks, it’s fair to note the potential benefits for certain borrowers:

1. Accessibility for All Credit Types

Eloanwarehouse removes the barrier of credit checks, allowing individuals with bad or limited credit history to access emergency funds.

2. Speed of Approval

Applications are processed quickly, and funds are often released within 24 hours. For urgent expenses like medical bills, car repairs, or rent payments, this speed can be vital.

3. Flexible Repayment Options

Unlike many payday lenders who demand repayment on the next paycheck, Eloanwarehouse allows repayment over 6 to 12 months, providing slightly more breathing room.

4. Fully Online Process

Borrowers can apply, review, and sign agreements without visiting a physical branch, which adds convenience and privacy.

The Hidden Risks and Cons of Payday Loans Eloanwarehouse

Despite the advantages, the downsides of Payday Loans Eloanwarehouse are substantial and often outweigh the benefits:

1. Skyrocketing Interest Rates

APR ranges from 400% to 700%, which is significantly higher than credit cards (15%–25%) or personal loans (6%–36%). These rates make repayment nearly impossible without rolling over debt.

2. Hidden Fees

Borrowers frequently report unexpected charges that inflate the total loan cost. The unclear fee structure places borrowers under unnecessary financial strain and doubt.

3. Risk of a Debt Cycle

High interest combined with fees often forces borrowers to take new loans to repay old ones, trapping them in a vicious debt spiral.

4. Aggressive Collection Practices

Numerous complaints mention relentless calls, harassment, and pressure tactics from Eloanwarehouse’s collection teams. This can negatively impact a person’s mental health and emotional stability.

5. Poor Customer Reviews

Borrowers often highlight issues such as unclear loan terms, unauthorized fees, and difficulty contacting support, making Eloanwarehouse an unreliable choice.

Comparison of Eloanwarehouse vs. Safer Alternatives

The following table compares Payday Loans Eloanwarehouse with other popular alternatives such as Earnin, Dave, and local credit unions.

| Feature | Eloanwarehouse | Earnin | Dave | Local Credit Union |

|---|---|---|---|---|

| Interest Rates | 400% – 700% APR | 0% (Tip-based) | Low, transparent | Typically <18% |

| Loan Amounts | $300 – $3000 | Up to $500 | Up to $100 | $500 – $5000 |

| Repayment Period | 6 – 12 months | Next payday | Pay cycle-based | Flexible, months–years |

| Approval Time | Within 24 hours | Same day | Same day | 1–3 business days |

| Credit Check | No | No | No | Required |

| Hidden Fees | Multiple | None | None | None |

| Application Method | Online login/app | App-based | App-based | Online/In-branch |

This comparison highlights how Eloanwarehouse is far more costly than its competitors, many of which offer low or no-interest options with more borrower-friendly repayment systems.

Who Might Consider Payday Loans Eloanwarehouse?

While financial experts typically warn against payday loans, some people might still find Eloanwarehouse appealing in extreme circumstances, such as:

-

Borrowers with No Credit History: Those who cannot qualify for credit cards or bank loans.

-

Emergency Situations: When funds are needed urgently and no other options are available.

-

Short-Term Use Only: Borrowers who can repay in full quickly may avoid long-term costs.

However, even in these cases, alternative lenders are almost always safer and more sustainable.

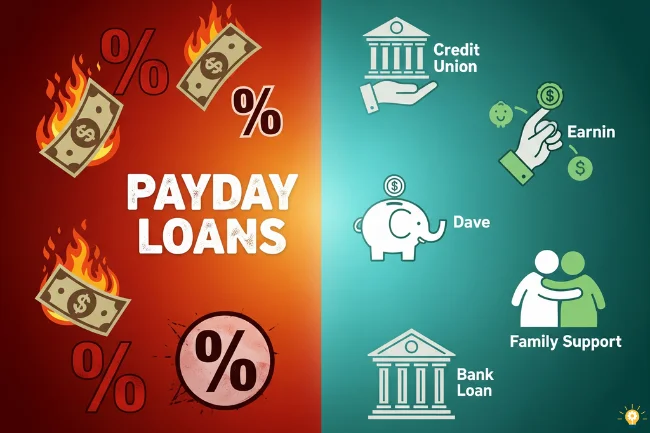

Safer Alternatives to Payday Loans Eloanwarehouse

If you’re considering payday loans, it’s worth exploring safer, more affordable options first:

1. Credit Unions

Offer personal loans at much lower rates (as low as 6%–18%). They often work with borrowers with poor credit.

2. Earnin

Let’s you access up to $500 of your paycheck early, with no interest — only optional tips.

3. Dave

Provides small cash advances ($100) with no credit check and minimal fees.

4. Personal Loans

Available from banks and online lenders, personal loans have longer terms and significantly lower rates.

5. Family or Employer Assistance

While not ideal for everyone, borrowing from family or asking for an employer advance is often cheaper and less stressful.

Risks of Falling into a Debt Trap

The biggest danger of Payday Loans Eloanwarehouse is the potential for borrowers to fall into a debt trap. With sky-high interest and unexpected charges, many borrowers are unable to repay on time. They end up borrowing again, perpetuating a cycle that damages their credit, finances, and mental health.

Conclusion: Should You Choose Payday Loans Eloanwarehouse?

Although Payday Loans Eloanwarehouse may appear to offer a fast solution during emergencies, the potential drawbacks overshadow the advantages. High interest rates, hidden fees, lack of transparency, and aggressive collection tactics make this lender a poor choice for most borrowers.

Instead, explore safer alternatives like Earnin, Dave, or local credit unions, which provide lower-cost and more sustainable options. Borrowers should always review loan terms carefully, avoid hidden traps, and consider long-term financial health before signing up for any payday loan.

Next Step: If you’re struggling financially, consider building an emergency fund, improving your credit score, and seeking advice from nonprofit financial counselors who can help you find better solutions.

FAQs About Payday Loans Eloanwarehouse

1. Are Payday Loans Eloanwarehouse legitimate?

Yes, they are legitimate lenders, but their high interest rates and hidden fees make them risky for most borrowers.

2. How quickly can I get funds from Eloanwarehouse?

Approved loans are usually funded within 24 hours, making it a fast option for emergencies.

3. What are the biggest risks of borrowing from Eloanwarehouse?

The biggest concerns are the excessive APR rates ranging from 400%–700%, unexpected fees, and harsh debt recovery methods.

4. Are there better alternatives to payday loans?

Yes. Earnin, Dave, and credit unions offer safer and more affordable lending options than Eloanwarehouse.

5. Who should avoid Payday Loans Eloanwarehouse?

Anyone struggling with debt or unable to repay quickly should avoid these loans, as they may lead to long-term financial hardship.

References:

- Consumer Financial Protection Bureau (CFPB) – Payday Loans Explained: https://www.consumerfinance.gov/consumer-tools/payday-loans/

- Federal Trade Commission (FTC) – Understanding Payday Loans: https://www.ftc.gov/

- NerdWallet – Best Payday Loan Alternatives: https://www.nerdwallet.com/

Learn About Doctorhub360.com Neurological Diseases

Salman Khayam is a business consultant at Siam IT Solutions, specializing in digital marketing, PPC, SEO, web development, e-commerce, and email marketing. He designs custom strategies that deliver measurable success.